This article orriginally appeared in Financial Express

‘Price-equalisation’ policies, mirroring some pre-liberalisation schemes, are distorting spatial distribution of renewable energy generation

Even a good policy with the best intentions can have unintended and adverse consequences. The Freight Equalization Scheme (FES) was one such policy meant to promote balanced industrial development throughout the country but ended up impeding the industrialisation of the mineral-rich eastern states. From 1956, consumers across the country got iron, steel, cement, and fertilisers at the same price, as the transportation was cross-subsidised. There was also a price control on coal, which ensured its availability at a fairly uniform price. This price equalisation deprived the mineral-rich states of their natural advantage of setting up downstream processing industries in the automotive, engineering, and energy sectors. As a result, industries developed in a few coastal states with large markets, such as Maharashtra, Gujarat, and Tamil Nadu, but states like West Bengal, Jharkhand, Odisha, Madhya Pradesh, and Chhattisgarh suffered. Consider this statistic: in 1950, West Bengal and Bihar accounted for 92% of all iron and steel production and 48% of all manufacturing output in engineering-related industries; in 1992, when FES was repealed, their share in engineering-related sectors was in the single digits.

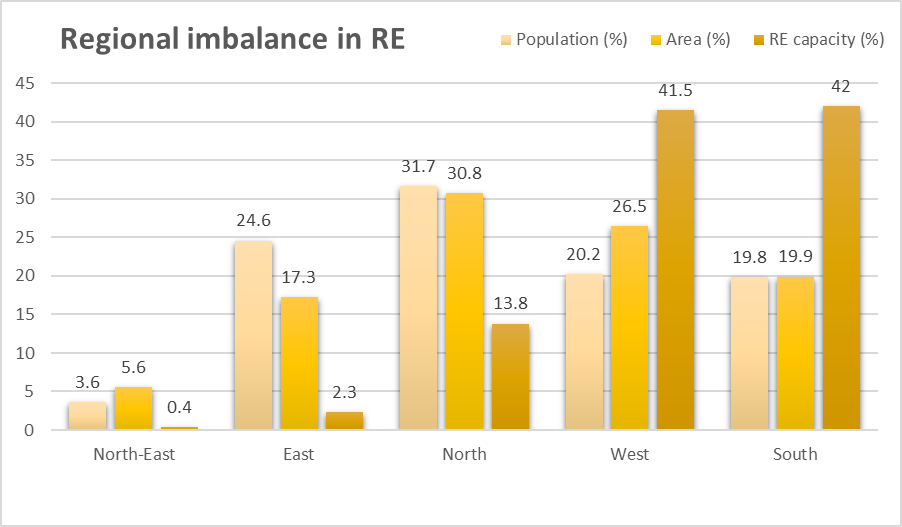

Presently, a similar “price equalisation” policy is being implemented in the renewable energy (RE) sector, which again threatens to create regional disparities in green industrialisation. This time, however, the price equalisation is to the advantage of the ‘resource-rich’ states, which happen to be in western and southern India, and to the disadvantage of the ‘resource-poor’ states, which are in northern and eastern India.

In the last 8.5 years, RE has grown exponentially from 31.7 gigawatts (GW) in 2014 to 114.4 GW in July, 2022. But most plants have come up in three western states (Rajasthan, Gujarat and Maharashtra) and four southern states (Andhra Pradesh, Karnataka, Tamil Nadu and Telangana). These seven states today account for more than 80% of RE in the country. On the other hand, northern and eastern states have lagged behind. For instance, the east and northeast, which account for 28% population and 23% geographical area, have only about 3% RE capacity. So, why this lop-sided growth in the RE sector?

There are three major factors. The first is the difference in RE potential between regions, the second is the availability of large parcels of land, and the third is the national RE policy. But overall, it is the RE policy that is amplifying the impact of potential and land. Let me explain.

There is a difference in solar and wind potential between states, more in the wind than solar. But this difference is not so high that RE plants, especially solar, cannot be installed in large parts of the country. In India, on average, a solar PV plant can generate 1400-1700 kWh/kWp per year, depending on solar insolation. So, the difference between the so-called solar-rich and poor states is only about 10-20%. But the point to note is that even the lowest solar insolation areas in India can generate 20-25% more electricity than Germany. Yet, Germany has more solar capacity than us. In a nutshell, most of parts of India have good solar potential; some regions have a little higher than others.

As far as land is concerned, it is true that states like Rajasthan and Gujarat have large patches of land where solar plants of hundreds of megawatts can be installed. But land and large artificial reservoirs are also available in north and eastern India. Odisha, Jharkhand and Chhattisgarh have vast wasteland and fallow land to install megawatt-scale plants. Uttar Pradesh and Bihar have massive potential to establish agri-solar. It is our policy to promote large solar plants that have made the land an issue. Otherwise, there are enough land, rooftops and reservoirs for balanced solar growth across the country. This brings me to the all-important factor, the RE policy.

Our RE policy is single-mindedly focused on installing large capacity at the lowest possible cost. The key instrument is the Renewable Purchase Obligation (RPO). Under this, states are required to meet a minimum percentage of their electricity requirement through RE. The RPO target for 2022-23 is 14.5%, which will increase to 43.33% by 2029-30. To meet the RPO targets, inter-state transmission system (ISTS) charges have been waived to allow ‘resource-poor’ states to buy the cheapest RE from anywhere in the country. ISTS charges have been wholly waived till June 2025 and will be progressively eliminated by 2028.

But ISTS waiver, a market distorting subsidy, is now a critical factor in deciding the location of plants. In a hyper-competitive RE market, the waiver, which could be as much as Rs 0.40-0.80/kWh or 15-30% of generation cost from large solar plants, is pushing companies to put up plants in western and southern India. RE-linked manufacturing — solar PV, battery and hydrogen electrolyser plants — are also moving to these states. As a result, an entire ecosystem is slowly getting entrenched in a few western and southern states, which is detrimental to RE development in the rest of the country. It is, therefore, time that we developed a more detailed understanding of the regional implications of the ISTS waiver and other RE subsidies and made necessary corrections quickly.

While installing large RE capacity is an important climate goal, it cannot be at the expense of shared prosperity. We must not allow India’s growth story to suffer by further widening the regional disparities.

Chandra Bhushan is one of India’s foremost public policy experts and the founder-CEO of International Forum for Environment, Sustainability & Technology (iFOREST).