Global Report Launch & Webinar: Just Transition, Just Finance

The International Forum for Environment, Sustainability & Technology (iFOREST) hosted a Global Report Launch and Webinar on January 9th, 2024, for the release of our report “Just Transition, Just Finance: Methodology and Costs for Just Energy Transition in India”. The report has been developed recognizing the need for an empirical basis to determine the cost of just energy transition, which can help countries to develop just transition plans, make necessary investments, and foster global partnerships for securing finances.

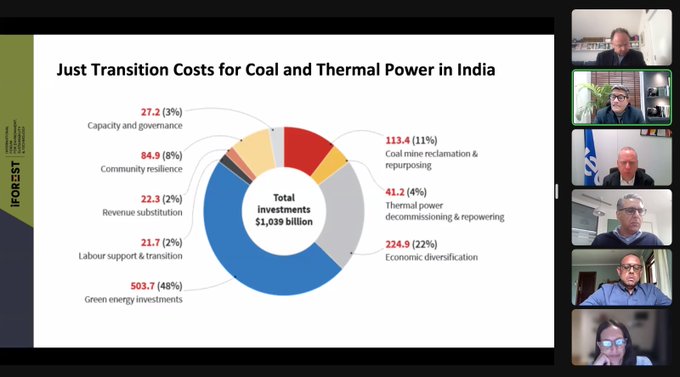

After the initial introduction by Ms Srestha Banerjee, Director – Just Transition, iFOREST, the webinar featured a detailed presentation by Mr Chandra Bhushan, President & CEO, iFOREST. Mr Bhushan pointed out that the methodology can also be tailored to estimate transition costs for a coal mine or a power plant – as for granular understanding of just transition costs, the pilot studies in 4 districts with different transition timeframes and transition challenges were considered.

The webinar featured eminent panelists including Ms Kate Hughes from Asian Development Bank (ADB); Dr Brian Motherway from International Energy Agency (IEA); Mr Dipak Patel from Presidential Climate Commission (South Africa); Mr Gagan Sidhu from Council on Energy, Environment and Water (CEEW); and Mr Nick Robins from Grantham Research Institute on Climate Change & the Environment.

Some of the key observations emphasized by our panelists were:

➡ Finance is required to make people’s life better. The need for training, including skill development support will be a key issue to prepare the workforce, including women and marginalized communities.

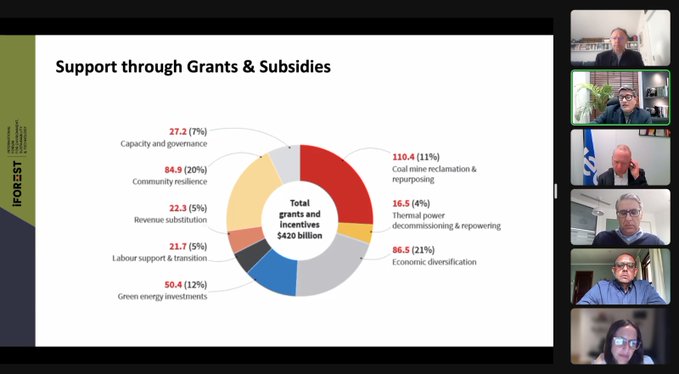

➡ There is presently a mismatch between where finance is needed and where it is flowing to support the Just Transition. It is crucial that there is clarity in institutional financing, especially of just transition components.

➡ There needs to be a substantial increase, especially in international climate financing and India is in a very good position to negotiate for it, given its importance in the global economy.

➡ The scale, nature and competing demands of capital are the three critical issues for Climate Finance. The good news is that the green energy investments, a major cost, can be self-supported.

➡ India’s just transition not just entails complexity of scale but also a complexity of diversity. Highlighting the country context for South Africa, it was mentioned that the support of the head of state was crucial for a Just Transition. However, there is an absence of grants in international financing, and this poses a risk of leaving many behind in this crucial transition.