Environmental, Social, Governance

Overview

India’s transition to a low-carbon, climate-resilient economy—while ensuring inclusive growth and a just transition—depends critically on its ability to mobilise climate finance at scale. A key precondition for attracting such finance is the availability of transparent, comparable, and verifiable corporate ESG information that allows investors and lenders to identify companies and sectors with credible transition pathways.

SEBI’s Business Responsibility and Sustainability Reporting (BRSR) framework has initiated the institutionalisation of ESG disclosures in corporate India, with the top 1,000 listed companies by market capitalisation now mandated to publish annual ESG reports. However, the current disclosure framework has limited sectoral specificity and insufficient visibility into forward-looking transition strategies.

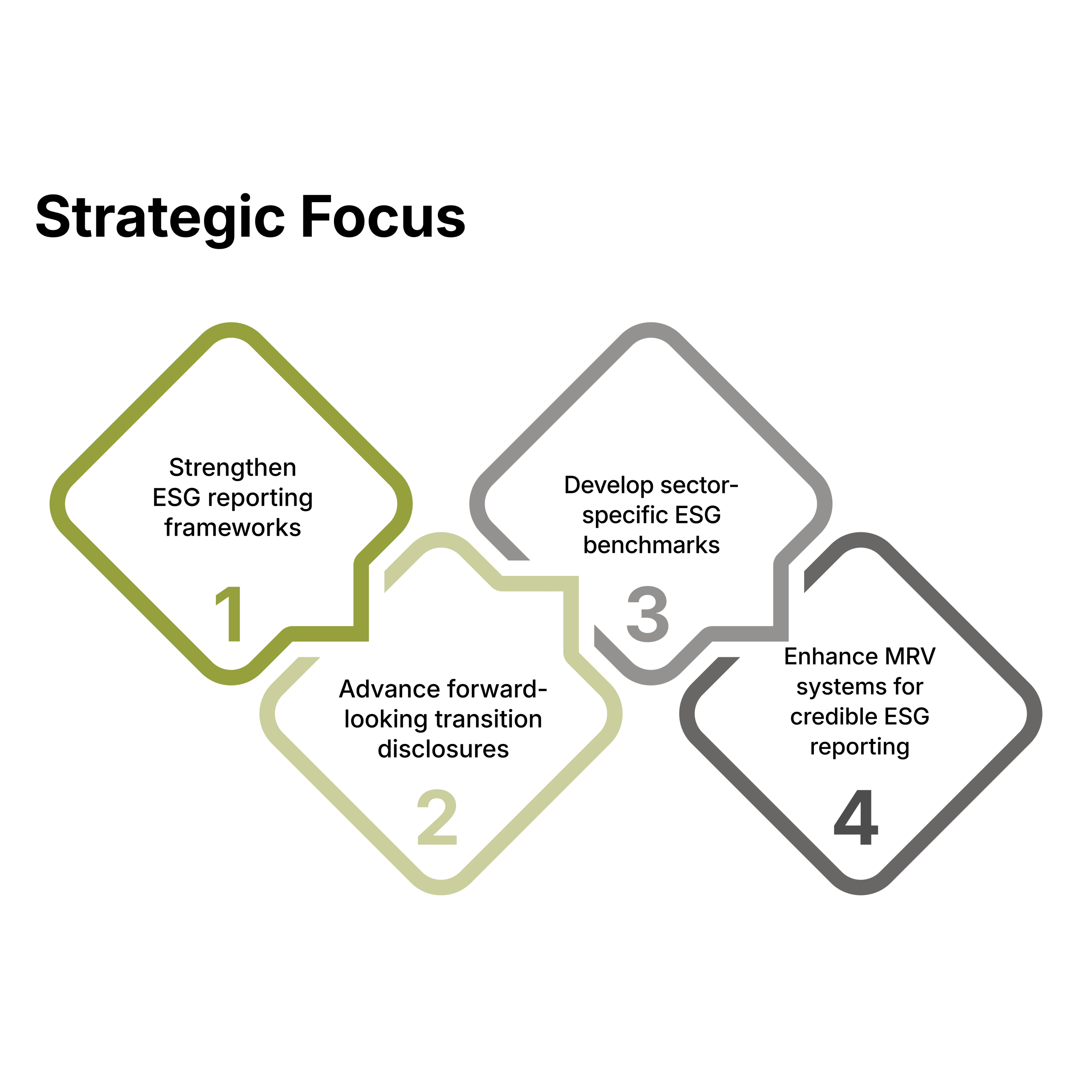

The ESG Programme focuses on strengthening ESG reporting and performance by advancing forward-looking transition disclosures, sector-specific benchmarks, and robust indicators. The programme also emphasises the development of strong measurement, reporting, and verification (MRV) systems to enhance the credibility of ESG data.

By improving transparency, comparability, and accountability, the programme seeks to enable investors and lenders to channel capital toward companies demonstrating credible, inclusive, and measurable transition pathways—at the scale and speed required for India’s climate transition.